온라인카지노의 쿠폰, 이벤트, 프로모션, 보증으로 더 많은 승리를 누리세요!

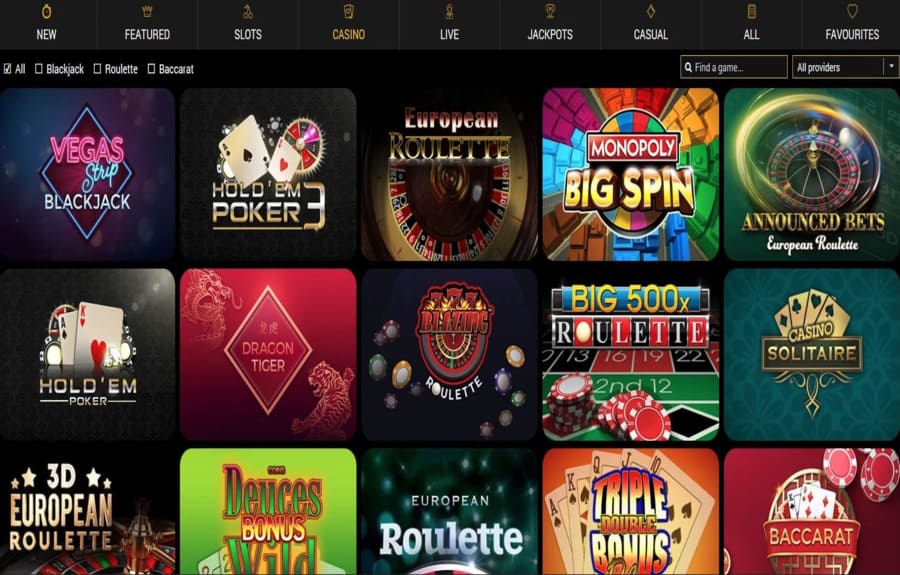

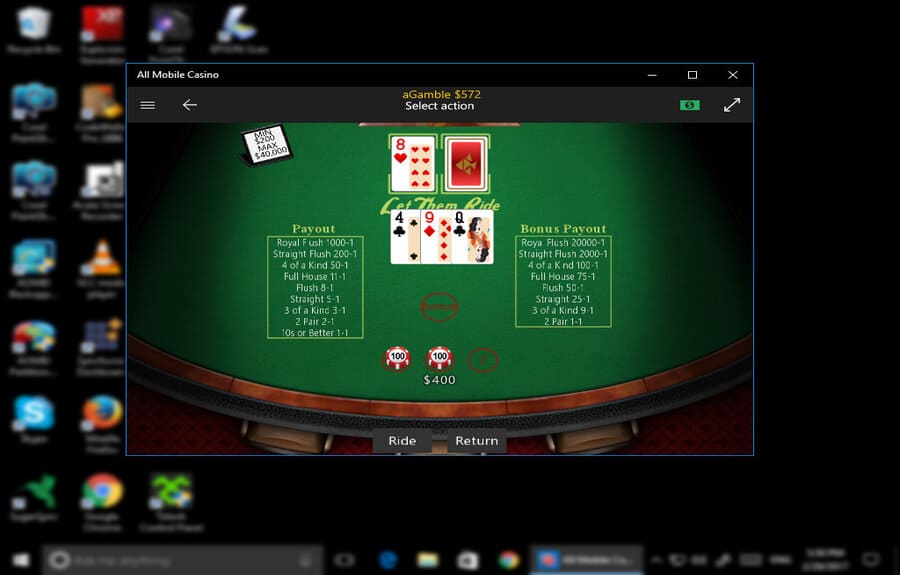

온라인카지노에서 즐기는 게임은 더 이상 단순한 오락이 아닙니다. 최근 온라인카지노 사이트들은 다양한 쿠폰, 이벤트, 프로모션, 그리고 보증을 통해 플레이어들에게 다채로운 혜택을 제공하고 있습니다. 이를 통해 높은 승리 기회를 얻을 수 있다는 것을 알고 계신가요? 온라인카지노의 장점 중 하나는 바로 다양한 쿠폰과 이벤트를 통해 추가 혜택을 받을 수 있는 점입니다. 대부분의...